How to Create a Layaway Program for an Online Store

What is Layaway?

Layaway is a purchasing arrangement Sale and Purchase Agreement The Sale and Purchase Agreement (SPA) represents the outcome of key commercial and pricing negotiations. In essence, it sets out the agreed elements of the deal, includes a number of important protections to all the parties involved and provides the legal framework to complete the sale of a property. where a retailer reserves and stores an item for a customer who has a predetermined period to pay for the item in full. The customer typically enters into an agreement to pay the full price for the item within an agreed period of time; failure to do so will cause the item to be returned to the retailer's shelves for other customers to buy.

In such cases, the customer's money may be returned in whole, minus a storage fee, or forfeited in whole, depending on the initial agreement between the store and the customer. Layaways come with minimal risks for the seller and provide a way of assisting customers with bad or simply no credit history, FICO Score A FICO score, more commonly known as a credit score, is a three-digit number that is used to assess how likely a person is to repay the credit if the individual is given a credit card or if a lender loans them money. FICO scores are also used to help determine the interest rate on any credit extended or those with a restrictive amount of disposable income to purchase higher-priced items.

How Layaway Transactions Work

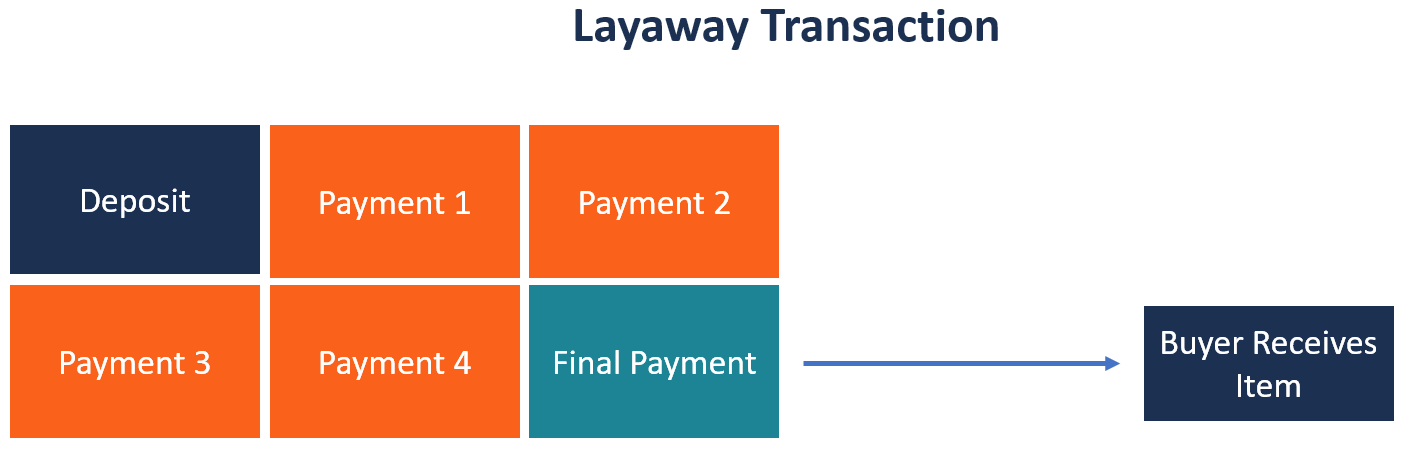

Different retailers impose different rules for layaway transactions. Typically, the basic process is as follows:

- The customer picks out the merchandise they want to put on layaway and takes it to the layaway or customer service department. The item must be among the list of products allowed for layaway terms, such as electronics or cosmetics.

- If the item is approved, the retailer will ask the customer to make a down payment. Some stores require a fixed percentage of the total price as a deposit, while others let the customer decide a fair amount of down payment for themselves.

- The next step is to choose the terms of the layaway plan. The retailer may allow a weekly, biweekly, or monthly payment plan, depending on the price of the item and the amount of the customer's disposable income. The scheduled payments must be made to retire the remaining balance of the purchase price, according to the agreed layaway plan.

- Once the customer has completed the scheduled payments and has a zero balance, he/she can pick up the item(s) from the retailer. Some retailers require customers to pay layaway fees, usually a minimal, flat-rate charge for storing the items during the payment period.

History of Layaway

Layaway transactions originated during the period of The Great Depression The Great Depression The Great Depression was a worldwide economic depression that took place from the late 1920s through the 1930s. For decades, debates went on about what caused the economic catastrophe, and economists remain split over a number of different schools of thought. when a lot of people did not have enough cash to make full payments for their merchandise. The retailers, aware of the cash crunch, allowed customers to make payments bit by bit, and to pick up the items when they completed paying the purchase amount in full. Layaway transactions were popular up until the 1980s and 1990s when they declined significantly as credit cards came into wider use.

Credit cards allowed customers to swipe their cards and take their merchandise on the same day while delaying the need to pay for the purchased merchandise. Customers would then pay back the credit to the lenders, plus interest, over an agreed duration of time. Most stores discontinued their layaway plans due to decreased demand, as most customers turned to credit cards.

During the 2008 Global Financial Crisis, credit became scarce, as more customers defaulted on their financial obligations. Banks also became bankrupt, Bankruptcy Bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that is unable to repay its outstanding debts and they were unable to collect defaulted debts and offer new credit to their customers. Stores such as Walmart resumed their layaway services in 2011 due to customers' growing financial difficulties and the need to increase dwindling revenues.

In the year 2012 during the holiday season, many other retailers resumed offering layaway services. The services are still offered in many major retailers such as Walmart Walmart Marketing Mix Walmart is a powerhouse of a business, and one of its key strengths is its marketing mix. Surviving in the retail market requires more than just luck , K-mart, Sears, and FlexPay.

Online Layaway

Online layaways are common among e-commerce stores. Introduction to E-commerce E-commerce refers to commercial transactions of goods or services conducted over the internet. E-commerce companies sell various products and services. They allow retailers to receive scheduled payments that are deducted from a customer's checking account until the payment for the item is completed. The customer is not required to physically visit the store to view the product and make payments, which helps save on fees related to storage. The items purchased on layaway terms are stored in distribution centers until the customer has paid the full amount.

The customer then picks up the product at a distribution center. Alternatively, retailers offer to ship to the customer's registered address for free or at a small cost. Online layaway services are available for various products and services, such as laptops, gym equipment, concert tickets, automobiles, homes, and vacations.

Benefits of Layaway

Layaways stand out among other financing methods for the following reasons:

Zero interest

When purchasing items through a layaway service, customers are not charged interest on the price of the item. This makes layaway a cheaper option, as compared to credit card purchases that charge customers interest of between 15 to 25%, and sometimes higher. The layaway services only charge a minimal, flat-rate service fee to cover storage costs.

Easy acceptance criteria

Layaway programs do not come with rigorous acceptance criteria like other financing methods. Retailers do not conduct credit checks, as is the case with credit cards. The programs only require proof of identification and a deposit for the item, making it an option for customers with past credit problems or without an established credit history.

Downside of Layaway

Strict payment terms

Layaway programs come with strict payment terms, and customers must make scheduled payments within the agreed time frame. Customers who fail to comply with these terms risk losing their items and incurring a cancellation fee.

Additional Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst. To keep learning and advancing your career, the additional CFI resources below will be useful:

- Balance of Payments Balance of Payments The Balance of Payments is a statement that contains the transactions made by residents of a particular country with the rest of the world

- Business Cycle Business Cycle A business cycle is a cycle of fluctuations in the Gross Domestic Product (GDP) around its long-term natural growth rate. It explains the

- Inflation Inflation Inflation is an economic concept that refers to increases in the price level of goods over a set period of time. The rise in the price level signifies that the currency in a given economy loses purchasing power (i.e., less can be bought with the same amount of money).

- Types of Buyers Buyer Types Buyer types is a set of categories that describe spending habits of consumers. Consumer behavior reveals how to appeal to people with different habits

How to Create a Layaway Program for an Online Store

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/layaway/